Uplifting Small Business Owners With Positive Capital

Navigating the Financial Labyrinth

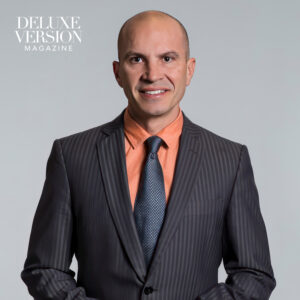

Over the last several years, Haley Hoppe has been at the forefront of securing business funding, not just as a financial strategy but as a personal mission. Driven initially by the capital-intensive nature of real estate investing, Haley sought alternatives to traditional hard money lenders, exploring a spectrum of financial tools including SBA loans, business lines of credit, and her preferred option, zero percent APR business credit cards.

These allow a full year of interest-free fund utilization, a boost for any entrepreneur.

This journey to becoming an industry maverick has been an educational odyssey. Haley immersed herself in mentorships, learning from industry leaders, absorbing not just tactics but the insider knowledge that typically eludes newcomers. This approach transformed her from a borrower into a knowledgeable financier, adept at the tricks of the trade.

The transition from personal financial management to a service-oriented business consultant was serendipitous. Initially assisting friends, Haley’s expertise in creative financing solutions spurred the launching of a business when peers encouraged her to formalize her services.

When asked why someone should seek her assistance, Haley’s response is simple yet effective:

“Have you tried securing funding before? What were your results?”

She regularly gets eight times the capital funding amount that an overwhelmed business owner can secure on their own while protecting personal credit through the entire process.

Haley’s business growth consultancy revolves around creating “good debt,” emphasizing robust security systems to safeguard client data while offering national funding using her creative financing models. Her ability to network extensively with bankers results in higher approvals that are many times what individuals might secure through standard applications. This showcases not just her networking skills but her understanding of the capital market’s nuances.

Targeting small business owners, Haley’s service fills a niche for those looking to expand without diluting equity. Her approach is tailored for the entrepreneur running operations, not just financial giants, often guiding clients through multiple rounds of funding.

Haley’s story is more than financial advice; it’s about empowerment through financial literacy and strategic capital acquisition. By demystifying the funding process and leveraging her extensive network, she’s not just funding businesses; she’s enabling entrepreneurs to navigate their financial futures with confidence and knowledge.

Learn more to take your business to the next level at growise.capital